Www.yieldcurve.com/Mktresearch/LearningCurve/BondFutures.pdf. The Federal Reserve Bank of San Francisco: Economic Research, Educational Resources, Community Development, Consumer and Banking Information. December 10, 2004 What Determines the Credit Spread?

John Krainer Although the swings in economic measures during the last recession and recovery were fairly modest, swings in financial markets were quite large. Once financial markets found their footing, after steep losses in 2000-2002, prices on virtually all traded financial claims rose as the economic outlook improved. This pattern was particularly true in the corporate bond market. The corporate bond market A corporate bond is a debt instrument issued by a legal corporate entity. The U.S. corporate bond market is large, with $6.8 trillion in outstanding corporate and foreign debt (that is, dollar-denominated debt issued in the U.S.) in the fourth quarter of 2003.

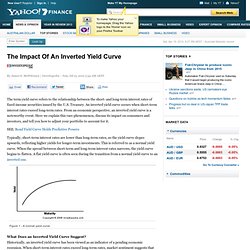

The Impact Of An Inverted Yield Curve. The term yield curve refers to the relationship between the short- and long-term interest rates of fixed-income securities issued by the U.S.

Treasury. An inverted yield curve occurs when short-term interest rates exceed long-term rates. From an economic perspective, an inverted yield curve is a noteworthy event. Here we explain this rare phenomenon, discuss its impact on consumers and investors, and tell you how to adjust your portfolio to account for it. Recession Coming! The Australian yield curve looks like a banana! The Interest Rate Banana Your Stocks Will Slip On.

Is Australia’s inverted yield curve signalling recession? Www.cepr.org/meets/wkcn/1/1716/papers/Bongaerts.pdf. JKP_CDS_1-10.pdf. Www.ccfr.org.cn/cicf2005/paper/20050201065013.PDF. Too late to avoid post-boom slump, experts say. Qantas-Emirates deal under a cloud. Former Qatas finance chief Peter Gregg ... Carnegie, Gregg may challenge Joyce’s Qantas plan. It is believed Peter Gregg and Mark Carnegie (pictured) about two months ago held a series of briefings with union groups, including those representing Qantas pilots, engineers and ground workers, in a bid to secure their support for a rival plan for Qantas that could include a more aggressive expansion into Asia.

Photo: Tomasz Machnik Andrew Cleary and James Chessell Former Qantas Airways finance chief Peter Gregg and venture capitalist Mark Carnegie have held discussions with key investors and unions as they consider a rival plan to challenge chief executive Alan Joyce’s strategy for the national carrier. Australian Govt pledges action on Google tax evasion. News The Australian Government has outlined a series of new legislative initiatives with which it will attempt to protect its corporate tax base and rein in the tax minimisation strategies of corporations such as search giant Google, which expects to pay just $74,000 in corporate income tax for the 2011 calendar year in Australia, despite making an estimated $1 billion in local revenue.

Click Frenzy shoppers to bag a bargain tonight. Mirroring the US giant online sale Cyber Monday, Australia’s first Click Frenzy will last 24 hours.

IMF risk assessment needs more debate. Australian Financial Review The Australian banking system weathered the last financial crisis well, but we need to ensure that it can also weather the next crisis.

That’s why last week’s International Monetary Fund assessment on the risks resulting from the very high concentration of major banks in our banking system and changing the deposit guarantee scheme so that banks bear the cost of bank failures, needs to be debated. Before the crisis, Australia’s big four banks did not indulge in risky sub-prime lending to any significant degree and they were closely supervised. The national dominance of the big four banks can be a source of financial stability, unlike the many small banks in the United States. Meeting focuses on Greek aid. Greece's lenders fail again to clinch debt deal. Stevens plays down IMF $A move. Big four banks to hold more capital: Stevens. ++ ‘Nike swoosh’ yield curve points to danger in 2014. The peculiar shape of Australia’s yield curve is posing a dilemma for the Reserve Bank of Australia.

Photo: Peter Braig Jonathan Shapiro The peculiar shape of Australia’s yield curve, dubbed the “Nike swoosh” by traders after the shoe logo, is posing a dilemma for the Reserve Bank of Australia. As long-term bond rates remain below the cash rate set by the RBA – partly because of strong foreign demand for local bonds – the swoosh of the curve predicts that the economy will get worse before it gets better. No central bank wants its economy to get worse. Further rate cuts may be ahead: RBA. Labor targets digital giants for tax. Google, David Bradbury said, was reported as having paid either $74,176 or $781,471 in tax last year, despite earning an estimated $1 billion-plus in Australia.

Photo: Harrison Saragossi Katie Walsh The federal government plans a tax crackdown on multinationals and has taken the extraordinary step of identifying two companies it believes are using complex structures to shift profits to lower-tax countries, US technology giants Google and Apple. Assistant Treasurer David Bradbury said multinationals that failed to pay their fair share of tax were “free riding on the efforts of others” by benefiting from government-funded infrastructure, human capital and institutions.

If unchallenged, they threatened to “erode Australia’s corporate tax base”, he said. “If enormous multinational corporations aren’t paying their fair share of tax on economic activity in Australia, then that’s not fair game,” Mr Bradbury told an Institute of Chartered Accountants tax conference in Sydney. PM, Abbott slam door on GST changes. Former Liberal leader John Hewson, regarded as the father of the GST, says a focus on short-term politics ahead of long-term economic reform risks years of low growth and rolling recessions.

Photo: Andrew Quilty Fleur Anderson, Katie Walsh and Greg Earl Prime Minister Julia Gillard and Opposition Leader Tony Abbott ruled out increasing or broadening the goods and services tax despite signals from the welfare lobby it is willing to consider raising the GST if there are other concessions. The Australian Council of Social Service, National Disability Services and Christian Schools Australia are concerned about financial pressures on government services and want a review of tax revenue.

Why Westpac is the best bank. Christopher Joye Groundbreaking research by Commonwealth Bank chief credit strategist Steve Shoobert has unearthed a new financial benchmark that can be used to value Australia’s banks. QBE to push for more women in key posts.