GPT wants to advance bid for Australand's commercial property unit. QBE debt issue means need for equity raising wanes. Megabank wants your super. Retail super funds up as banks cut fees. Banks behaving badly: HSBC settles in money laundering probe. The $1.92 billion deferred prosecution entered into by HSBC with US regulators is one of the most significant financial penalties imposed on a global bank.

On Tuesday in a Federal Court in Brooklyn, HSBC agreed to a legally binding settlement in which it accepted responsibility for systematic sanctions violations and the facilitation of money laundering on an industrial scale. It was also held accountable for threatening national security by providing financing facilities to a Saudi Arabian bank with links to terrorist groups. Outrageous HSBC Settlement Proves the Drug War is a Joke. HSBC's record $1.9bn fine preferable to prosecution, US authorities insist. HSBC and Standard Chartered to pay US over $2bn in charges. HSBC Fine for Money Laundering is Largest Bank Penalty in U.S. History. HSBC Fine Let Bank Avoid These Charges By accepting the settlement, HSBC avoided criminal charges. The bank agreed to deferred prosecution with the Manhattan district attorney's office and the Justice Department. Obama decided that political capital better spent elsewhere than on battle over Rice.

The decision was hers, senior administration officials said. Europe gets a banking union. I didn’t think they could manage it given the timeframes, but against my predictions Europe’s financial leaders have managed to pull together a deal for the beginnings of a banking union with an agreement to let the ECB become the supervisory authority for major European banks. The statement from the European council can be found here, and a good wrap is provided by OpenEurope: EU finance ministers last night reached a technical agreement on creating a new single financial supervisor at the ECB. The ECB will supervise banks with assets worth more than €30bn or 20% of their state’s GDP – thought to be around 200 out of 6,000 eurozone banks.

Macro Morning: Focus on the cliff. Ben Bernanke would have looked at the US PPI data last night and been convinced he is doing the right thing. During November producer prices fell 0.8% from -0.2% last and -0.5% expected with the year on year rate now sitting at just 1.5%. Of course the Fed Chairman is expressly targeting unemployment now and will keep rates low until the rate falls to 6.5% but for mine the real target of his unconventional monetary policy is deflation. The fiscal cliff: On the edge. The Fiscal Cliff: International Implications. Most of the discussion has focused on the domestic repercussions of going off the fiscal cliff (or as my former colleague Chad Stone calls it, the “fiscal slope”).

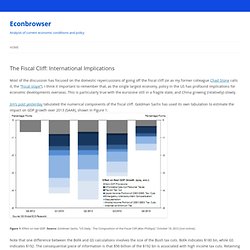

I think it important to remember that, as the single largest economy, policy in the US has profound implications for economic developments overseas. This is particularly true with the eurozone still in a fragile state, and China growing (relatively) slowly. Jim’s post yesterday tabulated the numerical components of the fiscal cliff. Goldman Sachs has used its own tabulation to estimate the impact on GDP growth over 2013 (SAAR), shown in Figure 1. Figure 1: Effect on real GDP. Note that one difference between the BofA and GS calculations involves the size of the Bush tax cuts. Nonetheless, with interest rates at zero, contractionary fiscal policy is likely to have large (negative) effects.

Www.imf.org/external/np/pp/eng/2012/070912.pdf. RBA has reason to fear ‘currency wars’ Karen Maley This past week, the Bank of England’s boss officially confirmed what Australian investors have long suspected: global central banks are now deliberately driving their currencies lower to spur exports and growth.

Mervyn King warned there was a risk of “currency wars” erupting next year as central banks vie with each other to drive their currencies lower in the hope of boosting exports. But many Australian investors – especially those with exposure to the manufacturing, tourism and mining sectors – say they are already suffering as a result of the world’s currency wars. They believe the dollar’s strength has a lot to do with huge bond buying programs launched by central banks in the United States, Britain, other European countries and Japan, which have artificially suppressed the value of the US dollar, the pound, the euro and the yen.

Ben, please give me more $$ AMFAutorité des Marchés Financiers. C'est l'autorité française de régulation des marchés financiers. Son équivalent pourrait être la SEC américaine.Equivalent de la SEC (Security Exchange Commission) américaine. N’a pas plus d’Autorité que sa consœur n’est gage de Sécurité (cf. Madoff) Appel de MargeDemande de reconstitution du compte de marge.Le pognon que tu dois envoyer quand tu es collé sur ta position. Arbitrage Stratégie de trading profitant d'incohérences momentanées entre les prix de plusieurs actifs ou contrats. Back-TestingTest de la validité d'un modèle ayant pour appui des données historiques.Excuse universelle: Je ne comprends pas, le fonds a perdu 5% et pourtant, quand on fait le back testing, il aurait dû en gagner 2% !

Bâle IIProcédures rénovées de calcul des capitaux propres que se doivent de posséder les banques. Fed move will stymie RBA’s $A control. United States Federal Reserve chairman Ben Bernanke’s move to print money has dashed hopes for a lower Australian dollar. Photo: Reuters Jason Murphy and Jacob Greber The US Federal Reserve’s decision to print money has dashed hopes for a lower Australian dollar and triggered warnings the Reserve Bank of Australia’s ability to lower the currency using interest rates is waning. In what has been dubbed a deepening global “currency war,” the US Fed announced an increase of its quantitative easing program to $US85 billion a month from $US40 billion by creating money and using it to buy bonds.

Japon: l’autre « mur budgétaire » Pessimism reigns: confidence at GFC-lows. Business confidence has fallen to the lowest level since the global financial crisis, as business conditions remained weak with little sign of a pre-Christmas revival, the National Australia Bank's monthly business survey shows. A strong Australian dollar, fiscal tightening and very weak confidence was expected to weigh on near-term activity and allow for a further Reserve Bank rate cut possibly in May 2013, the November NAB survey said. The monthly business condition index remained at minus 5, while business confidence fell to minus 9 from minus 1 in October. "Pessimism is the word this month, with business confidence the weakest since April 2009. Confidence did not rise in any sector and fell especially hard in manufacturing," NAB said. Advertisement. Bernanke walking a tightrope. Labor needs some lessons in chutzpah. Canberraobserved Laura Tingle Politics is a confidence game.

That, hopefully, is confidence in the Maria in The Sound of Music sense, rather than the Arthur Daley sense. It sometimes seems you can get away with almost anything in politics with the right amount of chutzpah. ++ Treasury to Swan: dump surplus plan. Laura Tingle Political editor Federal Treasury is advising the government to dump its commitment to a budget surplus as a slump in Australia’s nominal growth rate poses a threat to revenue. Treasury’s position reflects the views of many business figures and market economists who in recent months have dropped their support for getting the budget into surplus this year because of concerns that it could weaken the economy. The revelation comes after The Australian Financial Review reported last week that the government was preparing to dump its long-standing commitment to a surplus in 2012-13, and it had changed its rhetoric to emphasise the link between the surplus commitment and continuing growth in the economy.

The national accounts released last week showed that while real gross domestic product was growing at a trend rate of about 3.1 per cent, nominal GDP – upon which budget forecasts are based – slowed considerably this year to 1.9 per cent. ‘automatic stabilisers’ Deficits loom for next two years. Pip Freebairn. Surplus drivel. PM dismisses MP’s call to dump surplus. Construction jobs rebound as mining retrenches. How to make macroprudential policy work. IAG says good riddance UK. Www.afr.com/rw/Wires/Stories/2012-12-14/ASXAnnouncements/IAG_01367235.pdf. IAG flags loss of $240m from sale of UK operations. IAG pushes for debate on floods. Police concerned with Apple iOS 6 mapping system.