It's time for NAB chief Clyne to make hay. Unemployment drops as job seekers give up. Updated Thu 10 May 2012, 8:09pm AEST Australia's unemployment rate dropped to a 12-month low of 4.9 per cent last month in a surprise result as people gave up looking for work.

The latest figures from the Australian Bureau of Statistics show a total of 15,500 jobs were created in April on a seasonally-adjusted basis, driven by a jump in part-time work. While 26,000 part-time positions were created in the month, 10,500 full-time jobs disappeared. Prime Minister Julia Gillard and Federal Minister for Employment Bill Shorten welcomed the result. "I am delighted that today's unemployment rate has fallen to 4.9 per cent in April, an achievement for the Australian nation so soon after the global financial crisis," Ms Gillard said. RBA Labour Supply. Bulletin – June Quarter 2011 Ellis Connolly, Kathryn Davis and Gareth Spence * The labour force has grown strongly since the mid 2000s due to both a rising participation rate and faster population growth. The increase in participation has been greatest for females and older persons, driven by a range of social and economic factors.

At the same time, average hours worked have declined as many of these additional workers are working part time. Qantas fights for frequent flyers. Insurer Aviva's CEO quits after pay revolt. Insurer Aviva, which was hit last week by one of the biggest revolts over executive pay ever suffered by a British company, said today chief executive Andrew Moss had resigned from his position with immediate effect.

"Andrew Moss will leave the board shortly and a further announcement will be made to confirm the financial terms of his departure and date of leaving," Aviva's chairman Lord Sharman said, adding Moss thought his departure was in the company's best interests. Last week Moss waived his 2012 salary increase following shareholder concerns over executive pay, which culminated in half of the group's investors revolting on remuneration at its annual general meeting three days later. The group said chairman designate John McFarlane would take on his duties until a new chief executive was appointed. He will maintain an executive role while internal and external candidates are assessed for the CEO position, it added.

Slipper vacates Speaker's chair. Peter Slipper told parliament he denied the allegations and he was entitled to the presumption of innocence.

Photo: Alex Ellinghausen Peter Slipper on Tuesday denied allegations against him but told parliament he would remain out of the Speaker’s chair while federal police investigate claims he misused taxi dockets. Banks say they’ve got to pick a profit or two. NAB cost controls are a highlight. It’s Clyne’s strategy, he’s sticking to it. NAB solid, steady and all that jazz. CBA axes 100 jobs as loan demand drops. Winding back the banking clock. ANZ’s Smith signals full rate cut unlikely. NAB: so much for the ‘break-up’ For NAB, breaking up isn’t hard to do – it pays. Swan spruiks ‘fair go’ budget. Treasury does some digging to offer a mine of useful myth-busting. Fair share ...

"The mining tax will add about $3billion a year to the budget bottom line. This helps, but miners will still be paying slightly less than their share. " The Abbott Fact Check & Other Matters. The Leader of the Opposition Mr Abbott gave his response to the Budget a short while ago and while there were few facts relating to matters of the economy, there were a few assertions and judgments that should be put through the fact-check machine.

The lack of any detail about how the aspirations would be paid for is another matter, but at a quick glance, here is what came out: ABBOTT: People who work hard and put money aside so they won’t be a burden on others should be encouraged, not hit with higher taxes. FACT: The tax to GDP ratio of the first 5 Labor Budgets averaged 21.1%. The lowest ever tax to GDP recorded under the Howard government was 22.2% and the average was 23.4%. The last time a Coalition Government delivered a tax to GDP ratio below 21.1% was in 1979-80.

Federal Budget 2012. See the latest 2013 Federal Budget news and insights The Federal Budget creates opportunities.

S&P confirms Australia has no private debt. Elusive quest to capture market mood. Federal Budget 2012-13. What you need to know Federal Treasurer Wayne Swan has handed down his fifth Budget promising to deliver a surplus of $1.5 billion in 2012-13.

This will be the first surplus since Labor came to power in 2007. The fiscally conservative Budget will save $33.6 billion by reducing spending across almost every Government department and portfolio. Swan’s epic budget task faces economic reality. Infographic: Budget forecasts versus reality - Federal Budget 2012. Promised surplus likely to be a deficit. Swan's dangerous debt game. FEDERAL BUDGET 2012: Wayne Swan and Henry who? Trade deficit widens for March. Australia's trade deficit widened in March, the Australian Bureau of Statistics (ABS) said on Tuesday.

The balance on goods and services was a deficit of $1.59 billion in March, seasonally adjusted, compared with an upwardly revised deficit of $754 million in February. Economists' forecasts had centred on a deficit of $1.2 billion in March. During March, exports were up 2.0 per cent in adjusted terms while imports were up 5.0 per cent, the ABS said on Tuesday. Commonwealth Bank senior economist John Peters said flooding across eastern states during the summer months and industrial action at central Queensland mines had affected the supply of coal during the month. Revenue rides its own mining boom and bust. Budget driven by political necessity: Howard. Swan won’t commit to company tax cut. Return of old-fashioned fiscal discipline. Battlers and the big picture: budget's no game changer - The Drum Opinion - Clearly the sound-bite phrases of "fair go" and "battler's budget" imply what Swan wants us to think is the story, but do the cuts match it?

Find More Stories Battlers and the big picture: budget's no game changer Greg Jericho. Super changes sabotage certainty: AMP. AMP said net cash outflows were $292 million in the first quarter ended March 31.

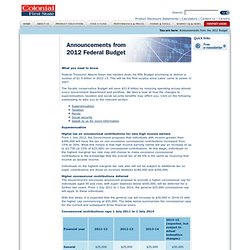

Higher earners face contributions tax slug. The proposals are the latest signal that the government is intent on dismantling a raft of super reforms introduced by former treasurer Peter Costello.

Sally Patten Older taxpayers will be limited to injecting $25,000 annually into superannuation for at least two years and high income earners face a doubling of their contributions tax in a move that will curtail people’s ability to save for their retirement. The measures, introduced as the government raises the level of compulsory contributions from 9 per cent to 12 per cent over the next eight years, are part of a $3.3 billion slug on savers revealed in the budget. Treasurer Wayne Swan also said he would scrap a planned tax break on bank deposits. AMP chair Mason says government is undermining super saving. AMP chairman Peter Mason has launched withering assessment of the government and its chief financial regulator at the investment house's general meeting.

The chairman of one of Australia's largest financial institutions said that constant changes to Australia’s superannuation system deterred workers from saving, while new capital requirements due to come into effect on January 1 would reduce Australia's competitiveness in the Asia-Pacific region. Payment services break plastic mould. Brian Corrigan Paying by smartphone is safer than a credit card – that is the message for consumers from the financial services industry now technology to enable payment online and in stores by the phones is about to come into use. MasterCard is launching a digital wallet service that will make it easier for shoppers to pay for goods and services, with an online-payment version expected in the third quarter.

Consumers will be able to register various addresses and credit cards to its PayPass Wallet Services. Bigger is better for mortgagees. Long wait for cheaper credit card rates. Smartphones ‘more secure’ than credit cards. Brian Corrigan Paying by smartphone is safer than a credit card – that is the message for consumers from the financial services industry now technology to enable payment online and in stores by the phones is about to come into use.

MasterCard is launching a digital wallet service that will make it easier for shoppers to pay for goods and services, with an online-payment version expected in the third quarter. Consumers will be able to register various addresses and credit cards to its PayPass Wallet Services. Get ready to gear up for extra profit. Focus on filling Buffett’s shoes. History of future stability. Voters Agree on One Thing: Discontent. Hollande’s political honeymoon won’t last long. Hollande's troubling memo to Merkel. Obama invites Hollande to White House. European leaders have welcomed the victory of Francois Hollande and US President Barack Obama has invited the French president-elect to the White House later this month. In a telephone call to congratulate Hollande on his election victory, Obama "indicated that he looks forward to working closely with Mr Hollande and his government on a range of shared economic and security challenges", White House spokesman Jay Carney said in a statement on Sunday.

Obama and Hollande "each reaffirmed the important and enduring alliance between the people of the United States and France", the statement read. The US president is due to host the leaders of the Group of Eight rich nation's club at his Camp David retreat in Maryland between May 18-19, followed by the NATO transatlantic alliance summit in Chicago on May 20-21. Greek voters reject euro zone austerity in. Resources hammered on EU uncertainty, US jobs. Nouriel Roubini's Global EconoMonitor » Get Ready for the Spanish Bailout. France simmers, Greece boils. France takes a left turn. Spain seizes Bankia as debt crisis escalates.